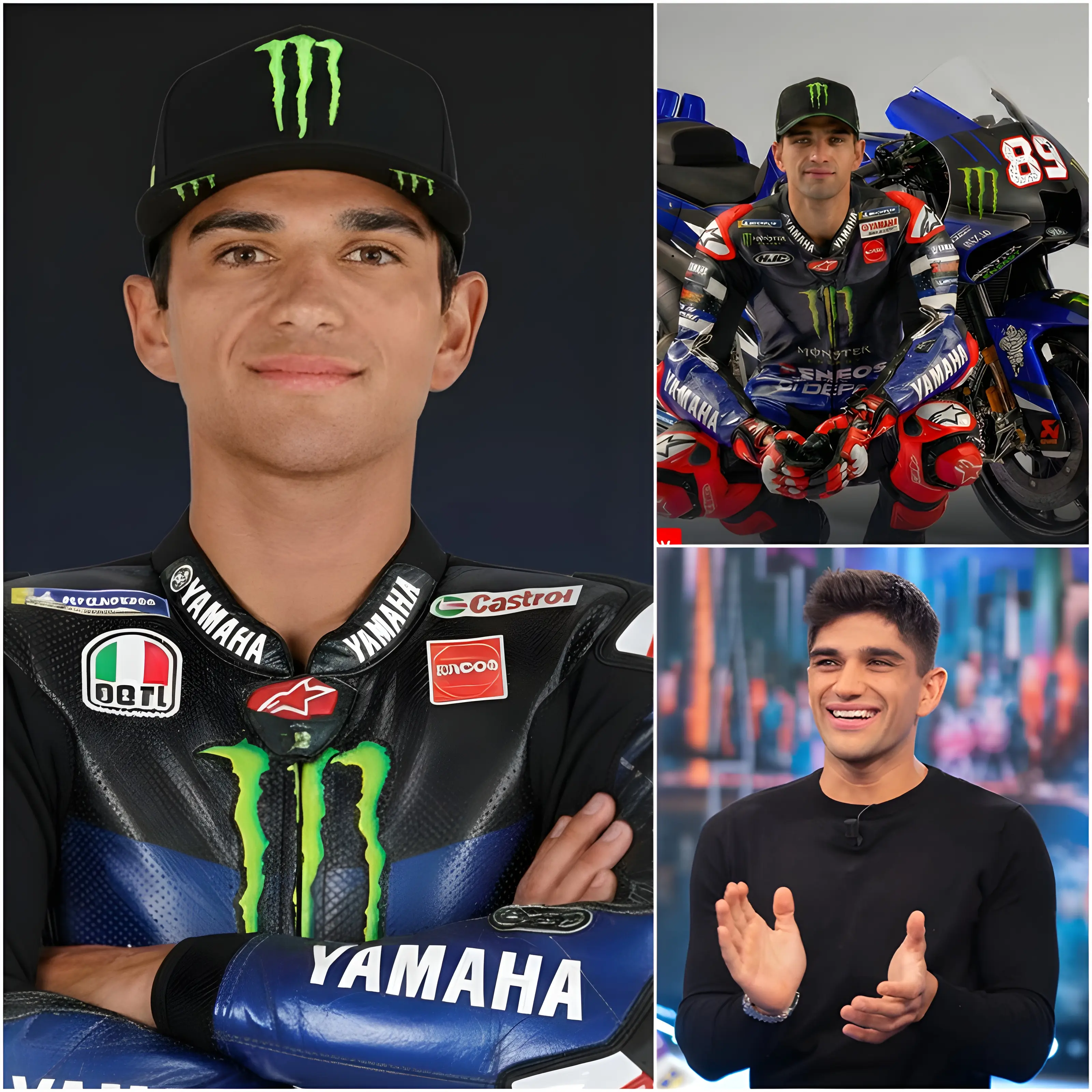

The MotoGP rider market has erupted into renewed chaos as the 2026 season draws closer, with fresh developments that underline just how volatile the current landscape has become. After months of speculation, sources close to the paddock indicate that Jorge Martín is seriously preparing to leave Aprilia following a turbulent and emotionally draining period, while Yamaha is said to be on the verge of finalizing a major deal that has gained momentum in the wake of Fabio Quartararo’s stunning decision to join Honda.

Together, these moves are reshaping expectations and accelerating a rider market that already feels unusually intense for this stage of the cycle.

Jorge Martín’s situation is at the center of attention. Once viewed as one of the most explosive and confident riders of his generation, Martín’s time at Aprilia has been marked by flashes of brilliance mixed with frustration and instability. While there have been moments where his raw speed and aggression shone through, consistency has remained elusive. According to those familiar with the situation, the relationship between rider and project has gradually eroded, not due to a lack of effort, but because of mismatched expectations and mounting pressure on both sides.

Martín is understood to feel that his prime years cannot be spent waiting for incremental progress. In a championship where margins are razor-thin and careers can pivot rapidly, patience is a luxury few riders can afford. Despite Aprilia’s continued commitment to development and its ambition to remain a title contender, the internal dynamics and repeated challenges have taken a toll. The possibility of Martín stepping away from the project before 2026 is now being discussed openly in the paddock, a sign that the situation has moved beyond quiet dissatisfaction into a decisive phase.

Aprilia, for its part, finds itself in a difficult position. Losing a rider of Martín’s caliber would be a significant blow, not just in terms of performance but also in terms of image and momentum. The manufacturer has worked hard to establish itself as a serious force in MotoGP, and high-profile departures risk undermining that narrative. At the same time, there is an understanding that forcing an unhappy rider to stay rarely leads to success. As a result, discussions are believed to be taking place with an eye toward minimizing disruption while preparing for potential changes.

Running parallel to Martín’s uncertainty is Yamaha’s rapid movement in the market. The Japanese manufacturer has been under intense scrutiny following Fabio Quartararo’s shock announcement that he will join Honda in the future, a decision that sent shockwaves through MotoGP. Quartararo’s departure leaves Yamaha facing not only a performance challenge but also a symbolic one, as the French rider had become the face of its modern era. In response, Yamaha has moved swiftly, with insiders suggesting that a new deal is close to being sealed as part of a broader effort to reset its trajectory.

This near-finalized agreement is widely seen as a statement of intent. Yamaha is determined to demonstrate that it remains an attractive destination for top-tier talent, even in the aftermath of losing one of the sport’s most recognizable names. The manufacturer’s leadership has emphasized long-term vision, technical renewal, and a renewed commitment to competitiveness. By acting decisively in the rider market, Yamaha aims to stabilize its future and reassure both fans and partners that it is far from retreating.

The ripple effects of Quartararo’s move to Honda cannot be overstated. His decision has altered the balance of power and emboldened other riders to reconsider their own positions. In this environment, loyalty is increasingly weighed against opportunity, and long-term contracts are no longer seen as guarantees of continuity. The combination of regulatory changes on the horizon and shifting manufacturer strategies has created a sense that now is the moment to make bold choices.

For MotoGP as a whole, these developments highlight the increasingly dynamic nature of the rider market. Unlike previous eras, where top riders often remained anchored to a single manufacturer for extended periods, the current grid is characterized by fluidity and ambition. Riders are more informed, more vocal, and more willing to move if they believe their potential is being constrained. Manufacturers, in turn, are adapting by placing greater emphasis on flexibility and forward planning.

Fans are watching closely as the narrative unfolds. The prospect of Jorge Martín leaving Aprilia raises questions about where he might land and how his aggressive, high-risk style would fit into another project. Meanwhile, Yamaha’s impending deal invites speculation about how the team intends to rebuild its identity and competitive edge without Quartararo. Each rumor, each leaked detail, adds another layer to a story that is evolving almost daily.

What makes this moment particularly compelling is the sense that these moves are interconnected. Quartararo’s decision set off a chain reaction, creating openings, altering perceptions, and accelerating negotiations that might otherwise have progressed more slowly. Martín’s readiness to walk away from Aprilia reflects a broader shift in mindset across the grid, where riders feel empowered to take control of their destinies rather than waiting for circumstances to improve.

As 2026 approaches, it is becoming clear that the rider market will remain a central storyline. Contracts, once seen as anchors of stability, are now strategic tools, and alliances are increasingly shaped by long-term vision rather than short-term comfort. The current turbulence may be unsettling, but it also underscores the vitality of MotoGP as a sport that thrives on evolution and reinvention.

In the end, whether Jorge Martín ultimately leaves Aprilia and whether Yamaha’s near-sealed deal delivers the reset it promises, one thing is certain: the MotoGP rider market is far from settling down. With ambitions colliding and futures being rewritten, the road to 2026 is shaping up to be as dramatic and consequential off the track as it will be on it.